Who can apply?

Welcome to first direct, we can help you with services including Online Banking, Insurances, Credit Cards, Loans, Mortgages, Investments and Sharedealing. Find out more and join us today. Pay in a cheque using the App Stay safe from fraud Money wellness hub. First direct is on a mission to help people drop the excuses that stop us trying the things we've always wanted to do. From meringue making, to kirigami (it's like origami), our Dabble Sessions brought together three masters of their crafts to help Love Island's Iain Stirling (and a group of keen first-timers) find a new passion - or at least have some fun trying.

You. Probably. If you're over 18, a UK resident, haven't been declared bankrupt or registered for an Individual Voluntary Agreement in the last six years (or be in the process of doing so), and have a phone number and email address we can contact you with, we'd love to welcome you.

Sweep your change into your savings

First Direct Pay In Cheque By Post

A 1st Account also gives you the option to set up a 'sweep', which automatically moves any spare money from your 1st Account to a first directSavings Account on any date you choose.

Regular Saver Account

Get into a good savings habit and the future you will say thanks. Put away between £25 to £300 each month, for a fixed 12 month term, and we'll give you a fixed rate of 1.00% AER/gross p.a. Find out more about our Regular Saver Account.

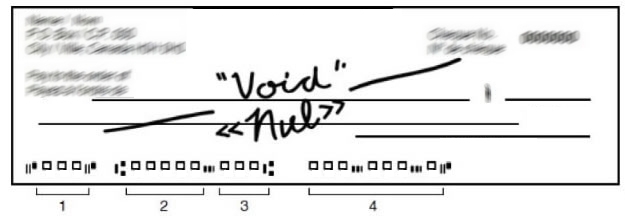

/dotdash_Final_Routing_Number_vs_Account_Number_Whats_the_Difference_Aug_2020-8939d2501c14490e8d85b94088a0bec9-1130ab2dae1b495b8cff8d988ebc9440.jpg)

A 1st Account also gives you the option to set up a 'sweep', which automatically moves any spare money from your 1st Account to a first directSavings Account on any date you choose.

Regular Saver Account

Get into a good savings habit and the future you will say thanks. Put away between £25 to £300 each month, for a fixed 12 month term, and we'll give you a fixed rate of 1.00% AER/gross p.a. Find out more about our Regular Saver Account.

Pay Cash Cheque

Interest example: if you save £300 every month for 12 months and qualify for the 1.00% AER/gross p.a. interest rate, you'll earn approximately £19.50 interest (gross).

AER stands for Annual Equivalent Rate. This shows you what the rate would be if interest were paid and compounded each year. Gross is the rate of interest if interest were paid and not compounded each year. No partial withdrawals allowed.